doordash quarterly tax payments

Select Vouchers for Next Years. How to make quarterly estimated tax payments with TaxSlayer.

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Youll receive a 1099-NEC if youve earned at least 600.

. From National Restaurants to Local Favorites DoorDash delivers the top restaurants. Do I have to pay quarterly taxes for DoorDash. Dashers also need to pay self-employment taxes which consist of your Social Security and Medicare taxes.

If you didnt work or owe taxes last year they also let you wait until April of next year according to their estimation tool. What tax forms will I get. The more tax deductions you take the less money youll pay in taxes.

You may send estimated tax payments with Form 1040-ES by mail or you can pay. The only tax form that eligible Dashers will receive is the 1099-NEC and this is ONLY for Dashers who earned 600 or more on the platform in. If you made more than 600 working for doordash in 2020 you have to pay taxes.

From National Restaurants to Local Favorites DoorDash delivers the top restaurants. Second Quarter Estimated Tax Payment Due. First Quarter Estimated Tax Payment Due.

Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes w Ease Confidence. Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Tax payment is due June 15 2021.

April 1 May 31. If youre in the 12 tax bracket every 100 in expenses reduces your. Ad Order right now and have your favorite meals at your door in minutes with DoorDash.

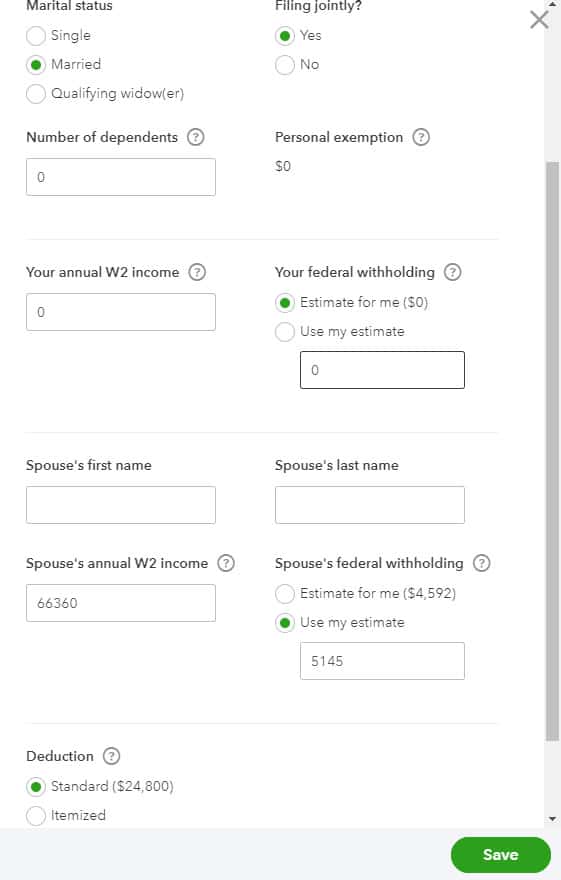

Log into your TaxSlayer account. My research in the irsgov site. When To Pay Estimated Taxes For estimated tax purposes the year is divided into four payment periods.

Do you owe quarterly taxes. In 2021 the tax rate is. DoorDash will send you tax form 1099.

Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. How much do Dashers have to pay in taxes. Since youre an independent contractor you might be responsible for estimated quarterly.

DoorDash drivers are expected to file taxes each year like all independent contractors. Doordash 1099 Taxes and Write offs. For many Dashers maximizing tax deductions means they pay less.

One last step is to multiply that by935. Tax payment is due. In QuickBooks Self-Employed go to the Taxes menu.

Click on Payments and Estimates. June 1 August 31. Ad Order right now and have your favorite meals at your door in minutes with DoorDash.

2022 Tax Year. Go to Federal Section. Tax payment is due April 15 2021.

You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed. Please note that the amounts on the 1099-K are not. Each year tax season kicks off with tax forms that show all the important information from the previous year.

Before I dig into how to calculate how much to send in for your quarterly tax estimates for Doordash Uber Eats Grubhub Postmates Lyft or any other independent. IRS doesnt want you to end up with a huge bill you cant pay. 153 124 Social Security tax and 29 Medicare tax If you are a high earner over 200k youd be subject to an additional.

The IRS may suggest quarterly payments if you expect to owe more than 1000 in taxes this year. Tax Forms to Use When Filing DoorDash Taxes.

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Our Clients Have A Clear Advantage Because They Use Our Automatic Business Expense Mileage Tracker Simplify To Assist Tax Deadline Tax Deductions Tax Season

How Do I File Doordash Quarterly Taxes Due Septemb

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

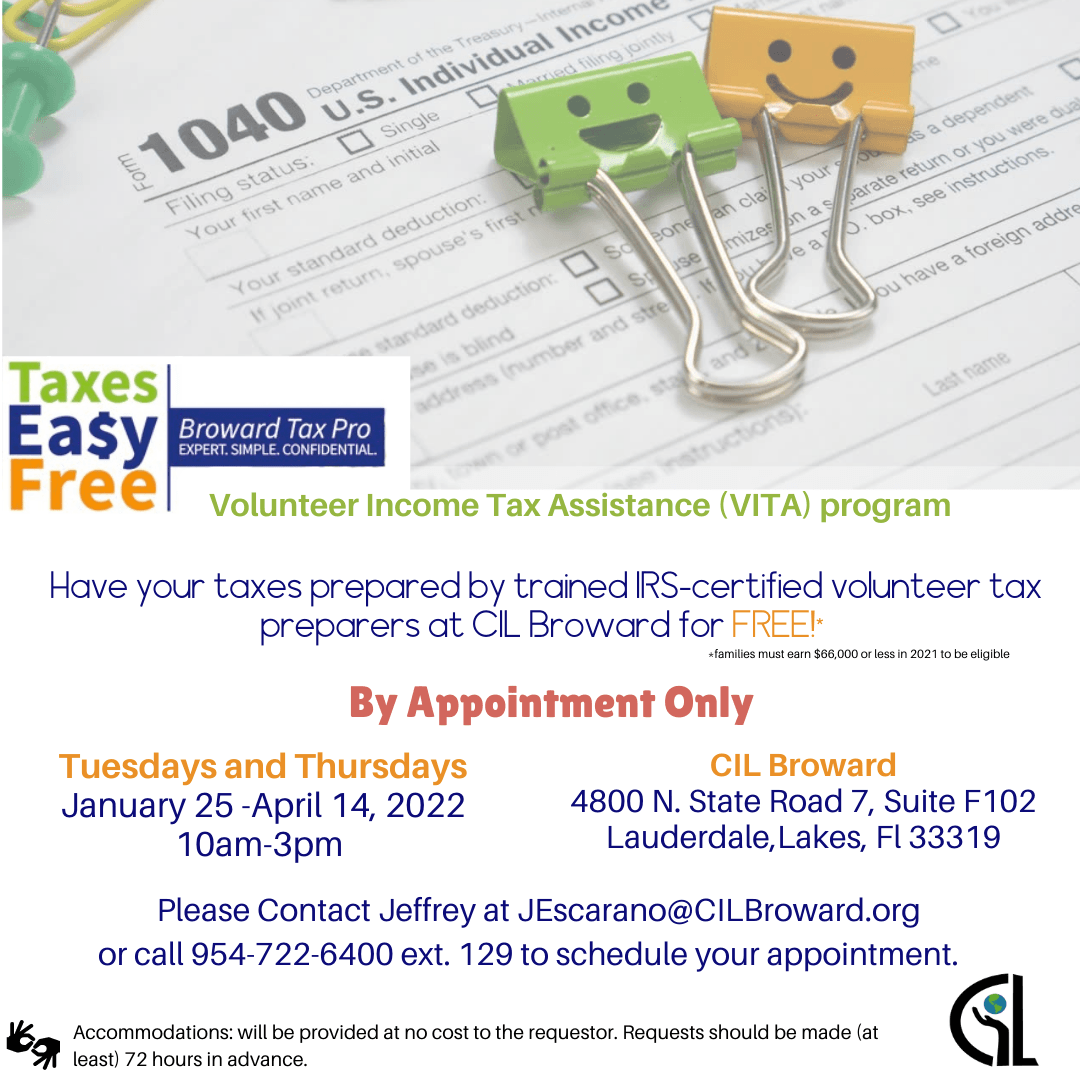

Still Waiting To Do Your Taxes Let Cil Broward Tax Prep Do It For Free

How Does Doordash Do Taxes Taxestalk Net

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

The Best Guide To Paying Quarterly Taxes Updated For 2021 Quarterly Taxes Estimated Tax Payments Tax Payment

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Door Dash Spreadsheet Track Your Costs Mileage Tracker Spreadsheet Tracking Mileage

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization

Small Business Tax Guide Tax Rates And Filing Tips Picnic S Blog